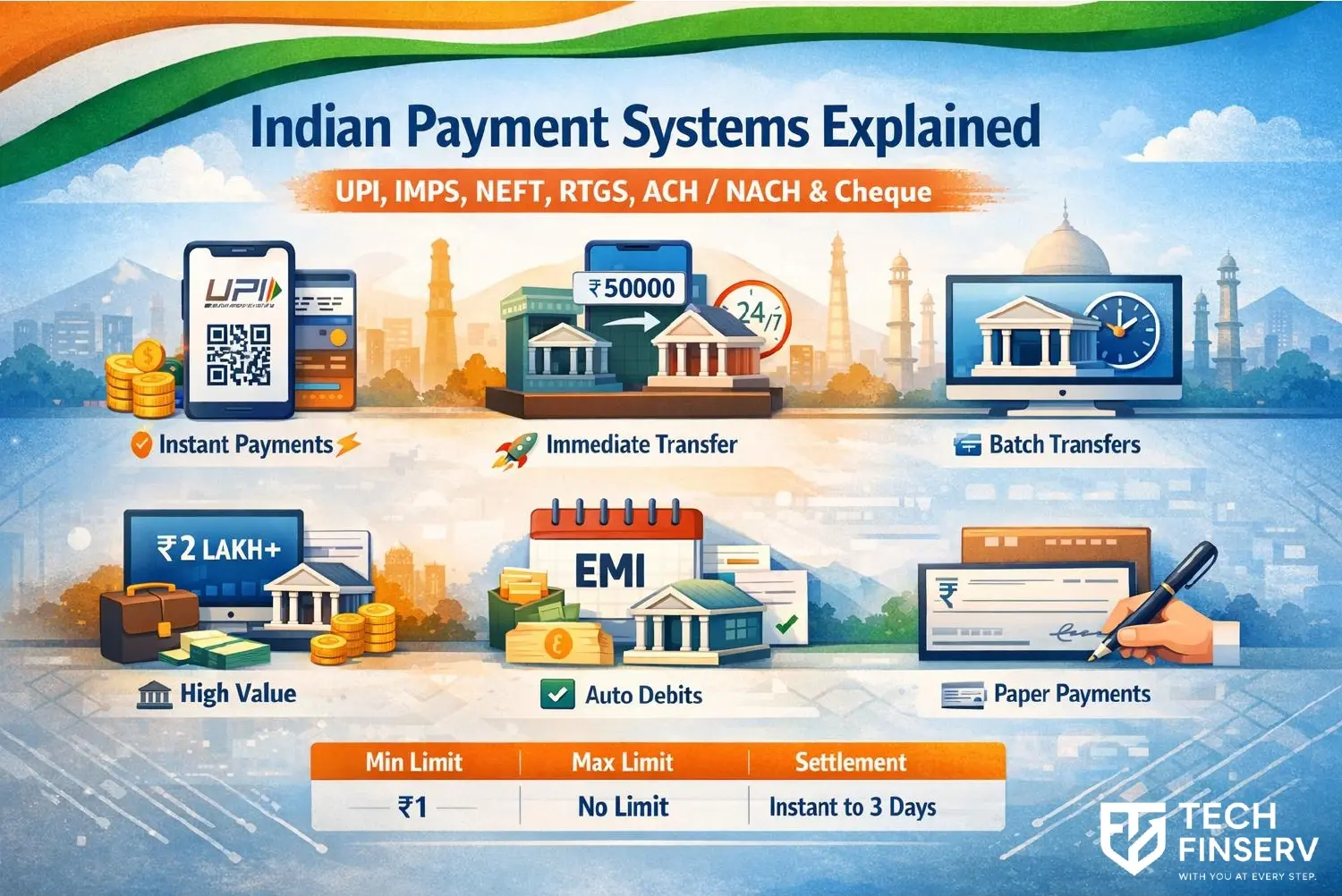

India has one of the most advanced, diverse, and rapidly evolving payment ecosystems in the world 🇮🇳. From instant mobile payments worth ₹10 to multi-crore corporate settlements, Indian payment systems are designed to handle transactions of every size, speed, and purpose.

Over the last decade, digital payments in India have grown exponentially 📈, driven by smartphone adoption, internet access, government initiatives, and strong regulatory oversight by the Reserve Bank of India (RBI).

Today, an individual or business can choose from multiple payment methods such as UPI, IMPS, NEFT, RTGS, ACH/ECS/NACH, and traditional Cheques, each built for specific use cases.

This comprehensive guide explains how Indian payment systems work, their minimum and maximum limits, settlement time, advantages, limitations, and when you should use each system — all in simple language 😊.

Understanding the Indian Payment System Landscape 🇮🇳

Indian payment systems can broadly be classified into the following categories:

- ⚡ Instant payment systems – UPI, IMPS

- ⏱️ Batch-based electronic transfers – NEFT

- 💰 High-value real-time systems – RTGS

- 🔁 Recurring / bulk payment systems – ACH, ECS, NACH

- 📝 Paper-based instruments – Cheques

Each system is regulated by RBI and operated through banks or authorised payment networks. Choosing the right system depends on speed, amount, frequency, and documentation needs.

1. UPI – Unified Payments Interface ⚡

UPI has completely transformed the way India pays. It allows instant bank-to-bank transfers using a mobile phone, without sharing sensitive bank details.

Whether you are paying for groceries, sending money to family, or scanning a QR code at a shop, UPI makes digital payments simple and fast 🟢.

Key Features of UPI

- ⚡ Instant real-time settlement

- 📱 Works through mobile apps

- 🔐 Secure authentication using UPI PIN

- 🕒 Available 24×7, including holidays

- 🧾 Supports person-to-person and merchant payments

UPI Transaction Limits

| Parameter | Limit |

|---|---|

| Minimum transaction | ₹1 |

| Maximum per transaction | ₹1,00,000 (higher for IPO, education, insurance) |

| Daily limit | ₹1–5 lakh (bank dependent) |

UPI is best suited for daily payments, small businesses, freelancers, and peer-to-peer transfers.

👉 Read more: UPI New Rules & Limits

2. IMPS – Immediate Payment Service 🚀

IMPS is an instant electronic fund transfer system that allows money to be sent between bank accounts in real time.

Unlike UPI, IMPS can be used through internet banking, mobile banking, and ATMs, making it useful when UPI is unavailable.

Key Features of IMPS

- ⚡ Instant settlement

- 🏦 Interbank transfers

- 🕒 Available 24×7

- 🔐 Secure banking channels

IMPS Transaction Limits

| Parameter | Limit |

|---|---|

| Minimum transaction | ₹1 |

| Maximum per transaction | ₹5,00,000 (bank dependent) |

IMPS is ideal for urgent transfers, especially when higher limits are required.

3. NEFT – National Electronic Funds Transfer ⏱️

NEFT is one of the most commonly used bank transfer systems in India. Unlike instant systems, NEFT transactions are settled in batches.

Even though NEFT is not real-time, it is extremely reliable and widely used for routine payments.

Key Features of NEFT

- 🏦 Available through all banks

- ⏱️ Settled in half-hourly batches

- 🕒 Available 24×7

- 💼 Preferred for business payments

NEFT Transaction Limits

| Parameter | Limit |

|---|---|

| Minimum transaction | No minimum limit |

| Maximum transaction | No RBI-imposed limit |

NEFT is suitable for salary payments, vendor payments, and routine transfers.

4. RTGS – Real Time Gross Settlement 💰

RTGS is designed exclusively for high-value transactions. Each transaction is processed individually and settled in real time.

Because of its certainty and speed, RTGS is widely used for large corporate and institutional payments.

Key Features of RTGS

- 💰 Real-time settlement

- 🏦 Highest transaction security

- 📊 Used for large-value payments

RTGS Transaction Limits

| Parameter | Limit |

|---|---|

| Minimum transaction | ₹2,00,000 |

| Maximum transaction | No upper limit |

RTGS is commonly used for property transactions, corporate settlements, and large investments.

5. ACH / ECS / NACH – Bulk & Recurring Payments 🔁

ACH (Automated Clearing House), ECS (Electronic Clearing Service), and NACH (National Automated Clearing House) are systems designed for bulk and recurring payments.

NACH is the modern replacement for ECS and is widely used across India today.

Common Use Cases

- 🏠 Loan EMIs

- 📄 Insurance premiums

- 🏢 Salary payments

- 📺 Utility bills

- 🏛️ Government subsidies

ACH / NACH Transaction Limits

| Parameter | Limit |

|---|---|

| Minimum transaction | No minimum |

| Maximum transaction | As per mandate and bank approval |

These systems are ideal for automated recurring payments and reduce manual effort.

👉 Plan EMIs smartly using: EMI Calculator

6. Cheque Payments 📝

Despite digital growth, cheques remain relevant in formal transactions. They provide physical documentation and legal validity.

Cheque Transaction Limits

| Parameter | Limit |

|---|---|

| Minimum amount | No minimum |

| Maximum amount | Depends on account balance |

Cheque clearing typically takes 1–3 working days.

Comparison Table: Indian Payment Systems 📊

| System | Min Limit | Max Limit | Settlement |

|---|---|---|---|

| UPI | ₹1 | ₹1–5 lakh | Instant |

| IMPS | ₹1 | ₹5 lakh | Instant |

| NEFT | No min | No limit | Batch |

| RTGS | ₹2 lakh | No limit | Real-time |

| NACH | No min | Mandate based | Scheduled |

| Cheque | No min | Balance based | 1–3 days |

Conclusion 🎯

India’s payment ecosystem offers unmatched flexibility and security. By understanding the features and limits of each payment system, users can choose the right method for every financial need.

For official guidelines, visit: Reserve Bank of India (RBI)

Explore more insights on finance and banking: TechFinserv Blog