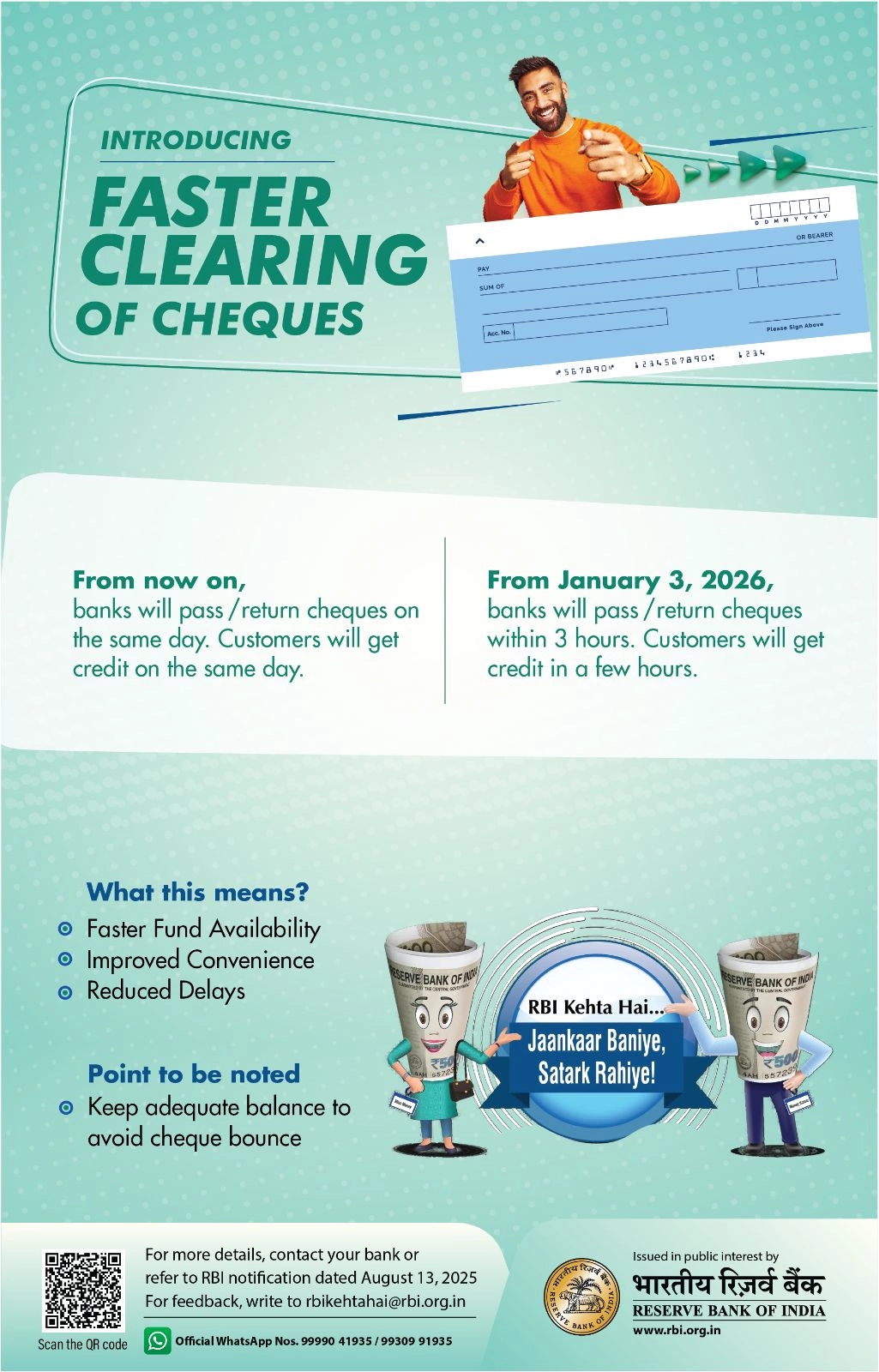

The Reserve Bank of India (RBI) has announced a major upgrade to the cheque clearing process that will make funds available faster than ever before. This move aims to make banking more efficient and customer-friendly, reducing delays and ensuring faster fund transfers.

📅 Timeline of Implementation

- From Now On: Banks will pass or return cheques on the same day. Customers will get credit on the same day.

- From January 3, 2026: Banks will pass or return cheques within 3 hours. Customers will receive credit within a few hours.

💡 What Does This Mean for You?

This change will transform how cheques are cleared in India. Here’s what customers can expect:

- ✅ Faster Fund Availability: You won’t have to wait for days for cheque clearance.

- ✅ Improved Convenience: Real-time processing ensures quicker access to your money.

- ✅ Reduced Delays: Faster inter-bank coordination eliminates waiting periods.

⚠️ Important Point to Note

Customers must ensure adequate balance in their accounts to avoid cheque bounce issues. Since cheques will be cleared faster, any shortage of funds could result in immediate cheque return.

🧾 Why RBI Introduced This Change

RBI’s decision aligns with its vision for a modern, digital, and efficient banking ecosystem. As online and real-time payment systems like UPI and NEFT grow, traditional cheque-based transactions also need modernization.

This change ensures that even cheque payments benefit from the speed and reliability of modern banking technology.

🏦 How It Benefits Businesses and Individuals

- For Businesses: Faster cash flow improves liquidity and reduces payment follow-ups.

- For Individuals: Immediate access to funds ensures timely bill payments, EMIs, and investments.

- For Banks: Automated clearing reduces manual workload and improves customer satisfaction.

🧠 Expert Insight – TechFinServ View

At TechFinServ, we believe this move is a major step toward a “real-time” financial ecosystem. It will help individuals and small businesses manage cash flow more effectively and promote trust in the banking system.

As cheque clearance becomes faster, maintaining a healthy account balance and tracking issued cheques becomes even more important.

🕒 What You Should Do Next

- ✔️ Keep track of issued cheques to avoid accidental bounce.

- ✔️ Ensure sufficient funds in your account before cheque clearance.

- ✔️ Use your bank’s SMS or app notifications to stay updated on cheque status.

💬 RBI’s Public Awareness Message

RBI’s official awareness campaign says:

“RBI Kehta Hai – Jaankaar Baniye, Satark Rahiye!” Stay informed and stay alert to make smart financial decisions.

📌 Key Takeaways

- 🕒 Same-day cheque clearing is already active.

- ⚡ From January 3, 2026, clearing will happen within 3 hours.

- 💸 Customers get faster fund access and reduced waiting times.

- 🚫 Always maintain sufficient account balance to avoid cheque bounce.

🌟 Conclusion

The RBI’s faster cheque clearing initiative is a major upgrade to India’s banking infrastructure. It will save time, improve liquidity, and make transactions smoother for everyone — from individuals to large businesses.

With this change, India moves one step closer to a seamless, real-time financial system. So, stay informed, keep your balance ready, and enjoy faster banking with confidence!

RBI Kehta Hai – Jaankaar Baniye, Satark Rahiye!

Disclaimer: This article is for informational purposes only and is based on publicly available RBI announcements. TechFinserv is not affiliated with the Reserve Bank of India (RBI). Readers should verify official details from the RBI website (www.rbi.org.in).

What is EMI ?

What is EMI ?

What is EMI in Loans Dicover it's Full Form, Meaning and smart tips to reduce Your Personal Loan And Home Loan EMIs Easily.

Read More → Flexi Hybrid Loan - Explained

Flexi Hybrid Loan - Explained

How Flexi ODs mix flexibility with lower cost.

Read More → Tips to Improve Credit (CIBIL) Score

Tips to Improve Credit (CIBIL) Score

Boost your credit (CIBIL) score efficiently with our simple and effective tips for better loan offers.

Read More →